In the world of trading, information is power. And while numbers, charts, and financial data are crucial for developing successful strategies, the events happening around the globe—political developments, natural disasters, and economic shifts—can have just as much influence on market performance. Welcome to the realm of fundamental trading, where traders make decisions based on real-world events and their potential impact on markets.

By the end of this lesson, you will be able to:

Understand the Impact of Global Events on Financial Markets: Recognize the significance of major global events—such as geopolitical events, natural disasters, policy changes, and economic shifts—and their effects on stock prices, sectors, and entire markets.

Interpret Market Sentiment from News: Learn to decipher how news stories shape market sentiment, triggering bullish or bearish trends, and how to react accordingly in your trades.

Analyze Economic Events and Reports: Understand how key economic events like central bank decisions, trade negotiations, and global financial crises influence the market’s performance and shape investment opportunities.

Utilize News for Trading Strategy Development: Apply insights from global news and events to build and refine your fundamental trading strategy, using a structured approach to manage risk and identify market trends.

Make Informed Decisions with a Data-Driven Approach: Combine traditional news analysis with data metrics and financial indicators to support decision-making, reducing the reliance on speculation and enhancing your trading edge.

As an investor, one of the most powerful tools at your disposal is the ability to interpret and act upon global news events. The financial markets are constantly influenced by the ebb and flow of information, with economic news, political developments, corporate earnings reports, and geopolitical shifts all playing a critical role in driving market behavior. The connection between news and numbers—how financial data and news narratives intersect—is a cornerstone of fundamental trading.

In this lesson, we’ll explore how to turn global news events into actionable trading insights. Whether it’s a surprise interest rate cut by a central bank, an unexpected geopolitical conflict, or a natural disaster affecting supply chains, understanding how such events influence the market’s numbers is vital to your trading strategy.

Global events are often the catalysts for significant market movements. These events can affect markets in both direct and indirect ways. Here are some key categories of global events that investors must pay attention to:

1. Geopolitical Events

Political instability, trade wars, military conflicts, and even diplomatic agreements can dramatically impact investor sentiment and market behavior. Geopolitical events typically create uncertainty, which can lead to market volatility, especially in sectors like commodities, defense, and emerging markets.

For example, tensions in the Middle East can cause fluctuations in oil prices, which in turn affect the stock prices of oil-related companies. Similarly, trade wars or sanctions can disrupt international supply chains, leading to stock price fluctuations in multinational companies.

2. Economic Data and Reports

Economic reports, such as GDP growth, inflation rates, and employment figures, are critical for assessing the health of an economy. These reports provide investors with insight into whether the economy is expanding or contracting and can heavily influence market behavior.

Interest rate decisions by central banks, such as the Federal Reserve or the European Central Bank, are another powerful example. A rate hike signals a tightening of the economy, often leading to lower stock market returns in the short term. Conversely, rate cuts can boost markets by making borrowing cheaper, which can spur investment and consumer spending.

3. Natural Disasters and Environmental Events

Natural disasters—earthquakes, hurricanes, and floods—can have both immediate and long-term effects on the markets. The immediate effects are usually seen in industries that are directly affected by the disaster (e.g., insurance companies or construction firms), while long-term effects can be felt in broader sectors, especially if the disaster impacts global supply chains.

For instance, the 2011 earthquake and tsunami in Japan disrupted production lines in the technology and automobile industries, leading to market volatility.

4. Corporate Announcements and Earnings Reports

While not necessarily “global” in the traditional sense, corporate earnings reports and major announcements can often be influenced by global events. For example, a company with significant exposure to a region affected by a political event might see its stock price affected by the news. Similarly, a company that benefits from global demand shifts—such as a tech firm seeing increased demand from new markets—may see its stock price react positively to favorable news.

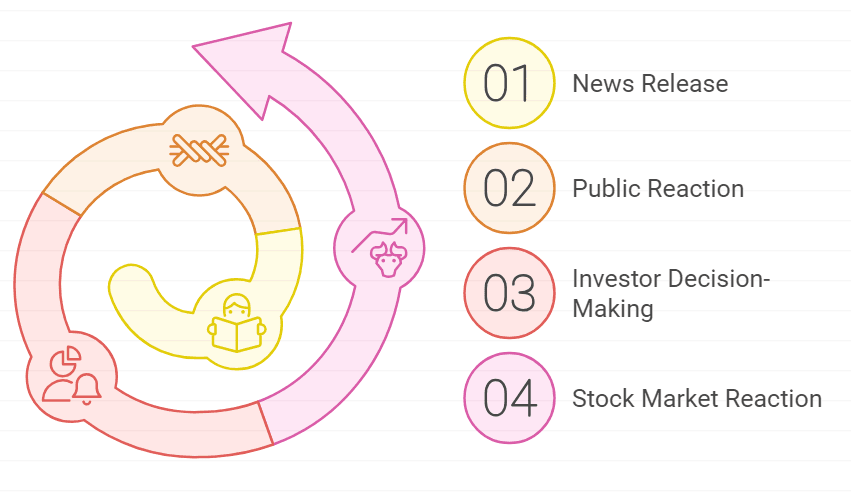

Understanding how news events influence stock prices is essential to navigating fundamental trading. While market movements are not always immediate, shifts in market sentiment often follow major news events. The key is to understand the underlying factors that contribute to these movements.

1. Market Sentiment and Investor Psychology

The concept of market sentiment revolves around the mood of investors—whether they are optimistic or pessimistic. News can quickly shape sentiment, influencing whether markets are in a risk-on or risk-off mode. Risk-on periods occur when investors are optimistic, often resulting in higher stock prices and more aggressive market behavior. Risk-off periods occur during times of uncertainty or fear, often leading to lower stock prices and a flight to safer assets like gold or government bonds.

For example, a news report announcing a breakthrough in vaccine development during the COVID-19 pandemic could cause a surge in stock prices, as investor sentiment becomes bullish, anticipating the return to normalcy. On the other hand, a new strain of the virus or concerns over government regulations could create a risk-off sentiment, leading to a market sell-off.

2. Economic Data and Its Impact

Economic data is one of the most direct forms of news that affects markets. Reports like GDP growth, unemployment rates, and consumer sentiment are fundamental to understanding how the economy is performing and predicting future market behavior. Investors use this data to forecast corporate earnings, which directly impact stock prices.

For example, a stronger-than-expected GDP report could signal a growing economy, prompting investors to move into equities in anticipation of higher corporate earnings. Conversely, disappointing job numbers or inflation data might cause traders to re-evaluate their bullish outlook and adjust their portfolios accordingly.

3. Central Bank Announcements

Central banks are arguably the most influential players in financial markets, as their policies impact everything from currency values to stock prices. Announcements of interest rate changes or quantitative easing programs can move markets dramatically.

A rate hike generally strengthens the currency, potentially reducing corporate profits for companies that rely on global markets, while a rate cut tends to weaken the currency and stimulate economic activity. Traders must monitor central bank meetings closely, as these events provide insight into the future direction of monetary policy and market conditions.

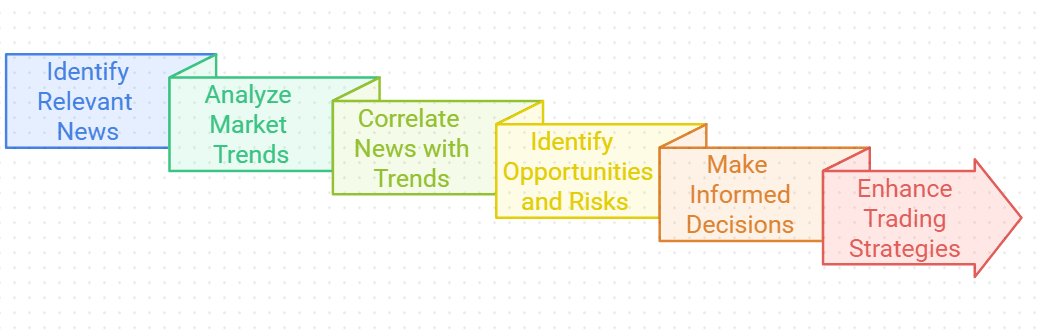

Once you understand the type of news events that drive market behavior, the next step is to turn this understanding into actionable trading strategies. Here’s how you can begin integrating global news into your fundamental trading approach:

1. Stay Informed and Act Quickly

Timing is critical when trading based on news. The market can react instantly to breaking news, and investors who stay informed through real-time updates can capitalize on these movements. Many platforms offer news feeds and alerts, allowing traders to monitor and assess news events as they happen.

Be sure to assess the credibility and potential impact of the news. Market reactions to news can sometimes be exaggerated, especially when speculation is involved. Having a clear strategy and using data to validate the news can help you avoid knee-jerk reactions.

2. Analyze the Bigger Picture

While individual events can lead to short-term volatility, it’s essential to understand the broader economic and political landscape. A single piece of news may cause temporary movements in the market, but you need to understand how it fits into the larger picture to make strategic decisions.

For example, the announcement of a new trade agreement may temporarily affect the currency markets, but in the context of an economy’s overall growth prospects, it could have long-lasting effects on trade balances and supply chains.

3. Incorporate Data into Your Strategy

As you move from news to numbers, always incorporate data and financial metrics into your analysis. News is often speculative, but data-driven insights provide you with concrete numbers that support or challenge the news. This approach can help you make more informed decisions and avoid acting on mere speculation.

For instance, if a report indicates an economic downturn, but the data shows strong consumer spending and low unemployment, it might suggest that the downturn is likely to be short-lived.

Not every profitable company is a good investment. Be aware of these potential red flags:

Inconsistent Cash Flow: Even profitable companies can struggle if their cash flow is unpredictable. Consistent negative cash flow from operations can be a warning sign.

High Debt: Excessive reliance on debt can indicate financial instability, especially if the debt is used to cover operating expenses rather than to fund growth.

One-Time Gains: Companies sometimes report one-time gains from selling assets or other non-operational activities. Be cautious, as these gains don’t reflect ongoing profitability.

By staying aware of these red flags, you can avoid potential pitfalls and make more informed trading decisions.

In conclusion, global events provide rich insights into market sentiment and the broader economic environment. By staying informed, analyzing the implications of major events, and integrating economic data into your trading strategy, you can make more informed decisions and position yourself for success in the financial markets.

It’s important to remember that effective trading is not only about reacting to news, but about integrating it with broader economic analysis, company fundamentals, and long-term trends. As you continue your journey, the ability to understand how news shapes the markets will become an invaluable tool in your trading arsenal.