By the end of this lesson, young investors will:

Understand Behavioral Finance Principles: Learn how biases like loss aversion, overconfidence, and anchoring impact investment decisions.

Identify Behavioral Traps: Recognize situations where emotions or cognitive biases might lead to poor financial decisions.

Build Resilience through Strategy: Develop an investment plan that accounts for human psychology, mitigates risk, and promotes consistent performance.

Apply Practical Techniques: Integrate tools such as diversification, rebalancing, and systematic investing to combat emotional decision-making.

Achieve Long-Term Investment Success: Leave equipped to navigate the financial markets with confidence, balance, and adaptability.

Investing is often described as a combination of art and science. But the hidden driver behind every financial decision is the human mind—our fears, desires, and biases. Behavioral finance shows us that even the smartest investors are susceptible to cognitive errors, which can lead to irrational decisions.

This lesson bridges the gap between understanding these psychological pitfalls and building an investment strategy that minimizes their impact. Think of this as your financial armor: a strategy designed not just to grow your wealth but also to protect it from the enemy within—your own emotions.

Let’s decode how to turn behavioral insights into actionable strategies for investment resilience.

The foundation of a resilient strategy is awareness. Before we can combat biases, we need to understand them.

What It Is: The fear of losing money is twice as powerful as the joy of gaining it.

Impact: Investors may sell winning investments too early or hold onto losing ones for too long, hoping to “break even.”

What It Is: Believing you know more than you actually do.

Impact: Overconfident investors often trade too frequently, leading to higher costs and lower returns.

What It Is: Fixating on a specific reference point, like the price you paid for a stock.

Impact: This can prevent rational decision-making, such as selling an asset that no longer aligns with your goals.

What It Is: Following the crowd instead of doing your own research.

Impact: This often leads to buying during market bubbles and selling during crashes.

Once you’re aware of the biases, the next step is designing a strategy that mitigates them.

Define your financial objectives: short-term (buying a house), medium-term (saving for college), and long-term (retirement).

Align your investments with these goals to stay focused during market turbulence.

Use tools like systematic investment plans (SIPs) or dollar-cost averaging to take emotions out of the equation.

Automation ensures that you invest regularly, regardless of market conditions.

Spread investments across asset classes (stocks, bonds, real estate) and regions to reduce risk.

Diversification minimizes the impact of individual asset failures and reduces panic during downturns.

Periodically review your portfolio and adjust allocations back to your target.

Rebalancing forces you to sell high and buy low, countering herd mentality and overconfidence.

Behavioral finance isn’t just about avoiding mistakes; it’s also about leveraging insights to make better decisions.

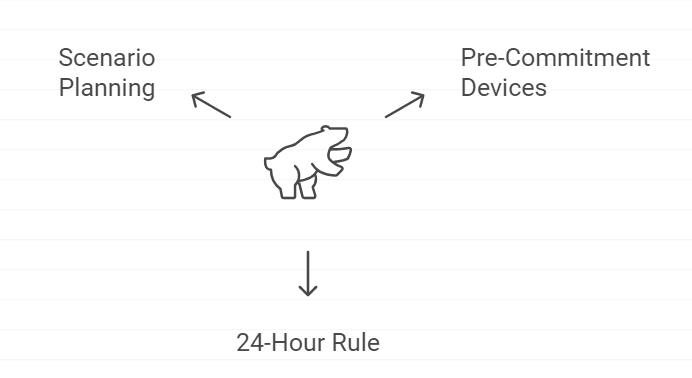

Create rules for yourself to follow during market volatility.

Example: “I will not sell my stocks unless they drop 20% from their value or exceed my target return.”

Avoid making impulsive decisions by giving yourself a cooling-off period.

Example: If you feel the urge to buy a stock because “everyone is talking about it,” wait 24 hours to reassess.

Visualize different market outcomes—bull, bear, and sideways.

Prepare responses for each scenario to reduce anxiety and impulsivity during real events.

Let’s say you’re building a strategy for retirement savings:

Goal: Save $1 million in 30 years.

Strategy:

Invest 60% in diversified equity funds and 40% in bonds.

Automate contributions through a monthly SIP.

Rebalance annually to maintain the 60/40 split.

Behavioral Insights Applied:

Loss Aversion: Recognize that temporary market dips are part of the process and avoid panic selling.

Overconfidence: Stick to your plan instead of timing the market.

Herd Mentality: Base decisions on your plan, not popular opinion.

By focusing on your long-term objective and using automation, you neutralize emotional triggers that derail many investors.

Markets change, and so should your strategy. However, evolution doesn’t mean abandoning discipline.

Use a journal to track your investment decisions, noting what worked and what didn’t.

Example: Did you buy a stock based on solid research or FOMO?

Stay informed about economic trends, but filter noise from valuable insights.

Example: Adjust your portfolio if a new sector shows consistent growth but avoid jumping on every trend.

Discuss your strategy with mentors, financial advisors, or fellow investors.

Constructive feedback can help you identify blind spots.

Problem: Making decisions based on fear or greed.

Solution: Rely on pre-defined rules and avoid checking your portfolio excessively.

Problem: Frequent trading leads to high fees and tax liabilities.

Solution: Focus on long-term investments with low turnover.

Problem: Expecting every investment to be a winner.

Solution: Embrace a diversified approach where some losses are offset by gains elsewhere.

Modern technology makes applying behavioral insights easier:

Robo-Advisors: Automate asset allocation and rebalancing.

Apps: Track your investments and spending to ensure alignment with goals.

Simulation Tools: Practice scenarios in virtual trading environments.

Congratulations! You’ve completed the behavioral finance module. By now, you understand the psychological traps that hinder investors and have learned how to use this knowledge to build a strategy that withstands market storms.

Resilient investing isn’t about avoiding all mistakes—it’s about recognizing them, learning, and improving. When you integrate behavioral insights into your strategy, you unlock a superpower: the ability to stay calm and disciplined, even when the market isn’t.

This journey doesn’t end here. It’s time to take your newfound knowledge and apply it to real-world investing. Remember, the smartest investors aren’t just those with the most information—they’re the ones who master their own behavior.

Thank you for embarking on this module. Here’s to your success in navigating the markets with clarity, courage, and consistency!

By the end of this lesson, young investors will:

Understand Behavioral Finance Principles: Learn how biases like loss aversion, overconfidence, and anchoring impact investment decisions.

Identify Behavioral Traps: Recognize situations where emotions or cognitive biases might lead to poor financial decisions.

Build Resilience through Strategy: Develop an investment plan that accounts for human psychology, mitigates risk, and promotes consistent performance.

Apply Practical Techniques: Integrate tools such as diversification, rebalancing, and systematic investing to combat emotional decision-making.

Achieve Long-Term Investment Success: Leave equipped to navigate the financial markets with confidence, balance, and adaptability.

Investing is often described as a combination of art and science. But the hidden driver behind every financial decision is the human mind—our fears, desires, and biases. Behavioral finance shows us that even the smartest investors are susceptible to cognitive errors, which can lead to irrational decisions.

This lesson bridges the gap between understanding these psychological pitfalls and building an investment strategy that minimizes their impact. Think of this as your financial armor: a strategy designed not just to grow your wealth but also to protect it from the enemy within—your own emotions.

Let’s decode how to turn behavioral insights into actionable strategies for investment resilience.

The foundation of a resilient strategy is awareness. Before we can combat biases, we need to understand them.

What It Is: The fear of losing money is twice as powerful as the joy of gaining it.

Impact: Investors may sell winning investments too early or hold onto losing ones for too long, hoping to “break even.”

What It Is: Believing you know more than you actually do.

Impact: Overconfident investors often trade too frequently, leading to higher costs and lower returns.

What It Is: Fixating on a specific reference point, like the price you paid for a stock.

Impact: This can prevent rational decision-making, such as selling an asset that no longer aligns with your goals.

What It Is: Following the crowd instead of doing your own research.

Impact: This often leads to buying during market bubbles and selling during crashes.

Once you’re aware of the biases, the next step is designing a strategy that mitigates them.

Define your financial objectives: short-term (buying a house), medium-term (saving for college), and long-term (retirement).

Align your investments with these goals to stay focused during market turbulence.

Use tools like systematic investment plans (SIPs) or dollar-cost averaging to take emotions out of the equation.

Automation ensures that you invest regularly, regardless of market conditions.

Spread investments across asset classes (stocks, bonds, real estate) and regions to reduce risk.

Diversification minimizes the impact of individual asset failures and reduces panic during downturns.

Periodically review your portfolio and adjust allocations back to your target.

Rebalancing forces you to sell high and buy low, countering herd mentality and overconfidence.

Behavioral finance isn’t just about avoiding mistakes; it’s also about leveraging insights to make better decisions.

Create rules for yourself to follow during market volatility.

Example: “I will not sell my stocks unless they drop 20% from their value or exceed my target return.”

Avoid making impulsive decisions by giving yourself a cooling-off period.

Example: If you feel the urge to buy a stock because “everyone is talking about it,” wait 24 hours to reassess.

Visualize different market outcomes—bull, bear, and sideways.

Prepare responses for each scenario to reduce anxiety and impulsivity during real events.

Let’s say you’re building a strategy for retirement savings:

Goal: Save $1 million in 30 years.

Strategy:

Invest 60% in diversified equity funds and 40% in bonds.

Automate contributions through a monthly SIP.

Rebalance annually to maintain the 60/40 split.

Behavioral Insights Applied:

Loss Aversion: Recognize that temporary market dips are part of the process and avoid panic selling.

Overconfidence: Stick to your plan instead of timing the market.

Herd Mentality: Base decisions on your plan, not popular opinion.

By focusing on your long-term objective and using automation, you neutralize emotional triggers that derail many investors.

Markets change, and so should your strategy. However, evolution doesn’t mean abandoning discipline.

Use a journal to track your investment decisions, noting what worked and what didn’t.

Example: Did you buy a stock based on solid research or FOMO?

Stay informed about economic trends, but filter noise from valuable insights.

Example: Adjust your portfolio if a new sector shows consistent growth but avoid jumping on every trend.

Discuss your strategy with mentors, financial advisors, or fellow investors.

Constructive feedback can help you identify blind spots.

Problem: Making decisions based on fear or greed.

Solution: Rely on pre-defined rules and avoid checking your portfolio excessively.

Problem: Frequent trading leads to high fees and tax liabilities.

Solution: Focus on long-term investments with low turnover.

Problem: Expecting every investment to be a winner.

Solution: Embrace a diversified approach where some losses are offset by gains elsewhere.

Modern technology makes applying behavioral insights easier:

Robo-Advisors: Automate asset allocation and rebalancing.

Apps: Track your investments and spending to ensure alignment with goals.

Simulation Tools: Practice scenarios in virtual trading environments.

Congratulations! You’ve completed the behavioral finance module. By now, you understand the psychological traps that hinder investors and have learned how to use this knowledge to build a strategy that withstands market storms.

Resilient investing isn’t about avoiding all mistakes—it’s about recognizing them, learning, and improving. When you integrate behavioral insights into your strategy, you unlock a superpower: the ability to stay calm and disciplined, even when the market isn’t.

This journey doesn’t end here. It’s time to take your newfound knowledge and apply it to real-world investing. Remember, the smartest investors aren’t just those with the most information—they’re the ones who master their own behavior.

Thank you for embarking on this module. Here’s to your success in navigating the markets with clarity, courage, and consistency!

Copyright © 2025 WallSt 101 All Rights Reserved.

WhatsApp us