When it comes to trading, a strong foundation in market fundamentals is essential. Whether you’re a seasoned investor or someone new to the market, understanding the fundamental forces that drive market prices is the cornerstone of successful trading. With the rise of algorithmic and AI-based strategies, it’s easy to forget that at the core of every trade is a fundamental truth about the asset’s value, supply, demand, and external factors. This blog will guide you through mastering these market fundamentals to elevate your trading strategies and become a more informed, confident investor.

Understand the Core Financial Statements: Identify and interpret the key components of the three primary financial statements—income statement, balance sheet, and cash flow statement—to gain a comprehensive view of a company’s financial health.

Analyze Key Financial Metrics and Ratios: Learn to assess a company’s profitability, liquidity, and valuation using essential metrics and ratios, including Price-to-Earnings (P/E), Return on Equity (ROE), Debt-to-Equity, and Earnings per Share (EPS), to gauge the company’s market performance accurately.

Apply Financial Data to Trading Strategies: Gain insights into how financial data supports different trading strategies such as value investing, growth investing, and dividend investing, and learn to use financial fundamentals to make informed and strategic trading decisions.

Identify Financial Red Flags: Recognize warning signs in financial statements, such as inconsistent cash flow and excessive debt, to avoid potential pitfalls and make more informed choices in uncertain markets.

With this foundation, you’ll be equipped to make informed, data-driven decisions based on a company’s financial performance, adding depth and stability to your trading strategy.

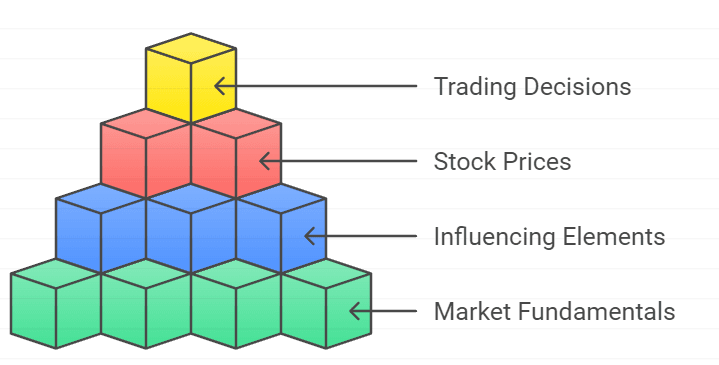

To succeed in any field, you must understand its underlying principles. Trading is no different. Market fundamentals refer to the intrinsic factors that influence the price of assets, including stocks, bonds, commodities, and currencies. These factors are crucial because, in the long run, they determine the true value of an asset.

For instance, take the stock market. The price of a stock doesn’t just move randomly—it’s influenced by several tangible and intangible elements, including company earnings, economic data, industry trends, and geopolitical events. Understanding these elements gives you the ability to anticipate future market moves and make better-informed decisions. In contrast, solely relying on technical indicators without considering the fundamental backdrop can lead to misguided trades.

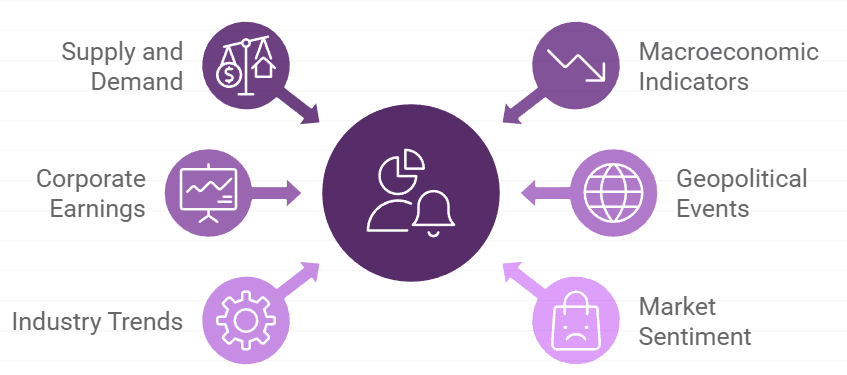

Supply and demand are the bedrock principles of any market. In trading, they define the relationship between how much of a commodity, stock, or currency is available (supply) and how much of it people want (demand). When demand outstrips supply, prices rise. When supply exceeds demand, prices fall.

In commodities trading, for example, a drought may lead to a shortage of crops, driving up prices due to lower supply. Similarly, a booming economy can increase demand for industrial metals, lifting their prices. Understanding these dynamics helps traders predict price movements before they occur, offering them a crucial edge.

The global economy directly impacts financial markets. Macroeconomic indicators such as GDP growth rates, unemployment figures, inflation data, and central bank interest rates are powerful tools for predicting market trends.

For example, higher-than-expected inflation can trigger a rise in interest rates as central banks seek to control price growth. Higher interest rates tend to reduce consumer spending and slow down the economy, causing stock prices to fall. Meanwhile, lower rates can stimulate the economy and lead to stock market gains. As a trader, paying close attention to these macroeconomic signals can help you time your trades to maximize returns.

For stock traders, the financial health of a company is paramount. Corporate earnings reports offer a glimpse into the profitability of a business, while the balance sheet reveals the company’s financial stability.

A company that consistently reports strong earnings growth is likely to see its stock price rise over time, as investors have confidence in its long-term potential. On the other hand, a company with high levels of debt and shrinking profits may see its stock price decline. Traders who follow quarterly earnings reports, monitor key financial metrics, and listen to management guidance are better equipped to make profitable decisions in the stock market.

Global politics also play a crucial role in shaping market fundamentals. Geopolitical events, such as elections, wars, trade disputes, and regulatory changes, can cause markets to move sharply. For instance, tariffs imposed during a trade war can make goods more expensive, hurting corporate profits and causing stock prices to fall.

In addition, political instability in a country rich in natural resources can affect the supply of key commodities like oil or natural gas, causing prices to surge. Savvy traders follow global news closely and incorporate geopolitical analysis into their trading strategies to better anticipate market shifts.

Different industries can experience their own economic cycles, independent of the broader economy. Understanding the trends and challenges within a specific industry is vital for trading related stocks or commodities.

For example, the tech sector might be booming due to advancements in artificial intelligence, while the energy sector might be facing challenges due to environmental regulations. Traders who stay on top of industry trends are better positioned to identify profitable opportunities and avoid potential pitfalls.

Sometimes, markets behave irrationally due to the psychology of traders and investors. Fear and greed drive market sentiment, which can lead to price fluctuations that seem disconnected from market fundamentals. For example, during a bull market, excessive optimism can push stock prices well above their intrinsic value, creating a bubble. Conversely, during a bear market, panic selling can drive prices far below what the fundamentals suggest.

While market sentiment may not be a fundamental factor in itself, understanding the mood of the market can help traders avoid making emotional decisions. A successful trader is one who remains objective and disciplined, focusing on the fundamentals even when the broader market is behaving erratically.

Once you’ve mastered the basics of market fundamentals, the next step is incorporating them into your trading strategy. Here’s how you can do that:

Before making any trade, it’s crucial to research the underlying asset thoroughly. This includes analyzing the company’s earnings, studying the broader industry, reviewing macroeconomic indicators, and keeping up with geopolitical news. The more information you have, the better your decision-making process will be.

While short-term price movements can be driven by technical factors, long-term price trends are typically rooted in fundamentals. Traders who focus on market fundamentals are better equipped to identify trends that can last months or even years. For example, an upward trend in corporate earnings may signal a long-term rise in the stock’s price, while declining oil inventories may point to higher oil prices in the future.

Trading based on fundamentals doesn’t mean you’re immune to losses. The market can be unpredictable, and even well-researched trades can go against you. That’s why risk management is a critical component of any successful trading strategy. Setting stop-loss orders, diversifying your portfolio, and managing position sizes are all important ways to protect yourself from significant losses.

The market is constantly evolving, and so should your trading strategy. While fundamentals can give you a strong foundation, it’s important to stay flexible and be willing to adjust your strategy as new information comes in. For example, a sudden geopolitical event or a change in monetary policy could cause a shift in the market that wasn’t anticipated. Being adaptable allows you to respond quickly to these changes and take advantage of new opportunities.

Even seasoned traders can make mistakes when it comes to market fundamentals. Here are some common pitfalls to watch out for:

It’s easy to focus too narrowly on the asset you’re trading without considering the broader global context. For example, a sudden change in oil prices can affect everything from energy stocks to transportation companies. Always take the global picture into account when making trading decisions.

While fundamentals should be the foundation of your trading strategy, ignoring market sentiment altogether can be a mistake. Sentiment can cause short-term price movements that may create opportunities for profit—or risk. Learn to balance both fundamentals and market psychology for a more holistic approach.

Markets are dynamic, and failing to adapt to new information can lead to losses. For example, if you’re holding onto a stock because the fundamentals were strong last quarter, but new data shows that the company is facing significant challenges, it may be time to reevaluate your position.

Mastering market fundamentals is the foundation of successful trading. By understanding supply and demand dynamics, keeping an eye on macroeconomic indicators, following corporate earnings, and staying informed about geopolitical events, you can build a strong, sustainable trading strategy. While the market may fluctuate in the short term, solid fundamentals will always give you a reliable guide to navigate through uncertainty.

Remember, success in trading isn’t about following the latest trend or using the flashiest indicators—it’s about understanding the forces that drive the market and using that knowledge to make informed decisions. As you continue to develop your skills as a trader, stay grounded in market fundamentals, and you’ll be well on your way to long-term success.

When it comes to trading, a strong foundation in market fundamentals is essential. Whether you’re a seasoned investor or someone new to the market, understanding the fundamental forces that drive market prices is the cornerstone of successful trading. With the rise of algorithmic and AI-based strategies, it’s easy to forget that at the core of every trade is a fundamental truth about the asset’s value, supply, demand, and external factors. This blog will guide you through mastering these market fundamentals to elevate your trading strategies and become a more informed, confident investor.

Understand the Core Financial Statements: Identify and interpret the key components of the three primary financial statements—income statement, balance sheet, and cash flow statement—to gain a comprehensive view of a company’s financial health.

Analyze Key Financial Metrics and Ratios: Learn to assess a company’s profitability, liquidity, and valuation using essential metrics and ratios, including Price-to-Earnings (P/E), Return on Equity (ROE), Debt-to-Equity, and Earnings per Share (EPS), to gauge the company’s market performance accurately.

Apply Financial Data to Trading Strategies: Gain insights into how financial data supports different trading strategies such as value investing, growth investing, and dividend investing, and learn to use financial fundamentals to make informed and strategic trading decisions.

Identify Financial Red Flags: Recognize warning signs in financial statements, such as inconsistent cash flow and excessive debt, to avoid potential pitfalls and make more informed choices in uncertain markets.

With this foundation, you’ll be equipped to make informed, data-driven decisions based on a company’s financial performance, adding depth and stability to your trading strategy.

To succeed in any field, you must understand its underlying principles. Trading is no different. Market fundamentals refer to the intrinsic factors that influence the price of assets, including stocks, bonds, commodities, and currencies. These factors are crucial because, in the long run, they determine the true value of an asset.

For instance, take the stock market. The price of a stock doesn’t just move randomly—it’s influenced by several tangible and intangible elements, including company earnings, economic data, industry trends, and geopolitical events. Understanding these elements gives you the ability to anticipate future market moves and make better-informed decisions. In contrast, solely relying on technical indicators without considering the fundamental backdrop can lead to misguided trades.

Supply and demand are the bedrock principles of any market. In trading, they define the relationship between how much of a commodity, stock, or currency is available (supply) and how much of it people want (demand). When demand outstrips supply, prices rise. When supply exceeds demand, prices fall.

In commodities trading, for example, a drought may lead to a shortage of crops, driving up prices due to lower supply. Similarly, a booming economy can increase demand for industrial metals, lifting their prices. Understanding these dynamics helps traders predict price movements before they occur, offering them a crucial edge.

The global economy directly impacts financial markets. Macroeconomic indicators such as GDP growth rates, unemployment figures, inflation data, and central bank interest rates are powerful tools for predicting market trends.

For example, higher-than-expected inflation can trigger a rise in interest rates as central banks seek to control price growth. Higher interest rates tend to reduce consumer spending and slow down the economy, causing stock prices to fall. Meanwhile, lower rates can stimulate the economy and lead to stock market gains. As a trader, paying close attention to these macroeconomic signals can help you time your trades to maximize returns.

For stock traders, the financial health of a company is paramount. Corporate earnings reports offer a glimpse into the profitability of a business, while the balance sheet reveals the company’s financial stability.

A company that consistently reports strong earnings growth is likely to see its stock price rise over time, as investors have confidence in its long-term potential. On the other hand, a company with high levels of debt and shrinking profits may see its stock price decline. Traders who follow quarterly earnings reports, monitor key financial metrics, and listen to management guidance are better equipped to make profitable decisions in the stock market.

Global politics also play a crucial role in shaping market fundamentals. Geopolitical events, such as elections, wars, trade disputes, and regulatory changes, can cause markets to move sharply. For instance, tariffs imposed during a trade war can make goods more expensive, hurting corporate profits and causing stock prices to fall.

In addition, political instability in a country rich in natural resources can affect the supply of key commodities like oil or natural gas, causing prices to surge. Savvy traders follow global news closely and incorporate geopolitical analysis into their trading strategies to better anticipate market shifts.

Different industries can experience their own economic cycles, independent of the broader economy. Understanding the trends and challenges within a specific industry is vital for trading related stocks or commodities.

For example, the tech sector might be booming due to advancements in artificial intelligence, while the energy sector might be facing challenges due to environmental regulations. Traders who stay on top of industry trends are better positioned to identify profitable opportunities and avoid potential pitfalls.

Sometimes, markets behave irrationally due to the psychology of traders and investors. Fear and greed drive market sentiment, which can lead to price fluctuations that seem disconnected from market fundamentals. For example, during a bull market, excessive optimism can push stock prices well above their intrinsic value, creating a bubble. Conversely, during a bear market, panic selling can drive prices far below what the fundamentals suggest.

While market sentiment may not be a fundamental factor in itself, understanding the mood of the market can help traders avoid making emotional decisions. A successful trader is one who remains objective and disciplined, focusing on the fundamentals even when the broader market is behaving erratically.

Once you’ve mastered the basics of market fundamentals, the next step is incorporating them into your trading strategy. Here’s how you can do that:

Before making any trade, it’s crucial to research the underlying asset thoroughly. This includes analyzing the company’s earnings, studying the broader industry, reviewing macroeconomic indicators, and keeping up with geopolitical news. The more information you have, the better your decision-making process will be.

While short-term price movements can be driven by technical factors, long-term price trends are typically rooted in fundamentals. Traders who focus on market fundamentals are better equipped to identify trends that can last months or even years. For example, an upward trend in corporate earnings may signal a long-term rise in the stock’s price, while declining oil inventories may point to higher oil prices in the future.

Trading based on fundamentals doesn’t mean you’re immune to losses. The market can be unpredictable, and even well-researched trades can go against you. That’s why risk management is a critical component of any successful trading strategy. Setting stop-loss orders, diversifying your portfolio, and managing position sizes are all important ways to protect yourself from significant losses.

The market is constantly evolving, and so should your trading strategy. While fundamentals can give you a strong foundation, it’s important to stay flexible and be willing to adjust your strategy as new information comes in. For example, a sudden geopolitical event or a change in monetary policy could cause a shift in the market that wasn’t anticipated. Being adaptable allows you to respond quickly to these changes and take advantage of new opportunities.

Even seasoned traders can make mistakes when it comes to market fundamentals. Here are some common pitfalls to watch out for:

It’s easy to focus too narrowly on the asset you’re trading without considering the broader global context. For example, a sudden change in oil prices can affect everything from energy stocks to transportation companies. Always take the global picture into account when making trading decisions.

While fundamentals should be the foundation of your trading strategy, ignoring market sentiment altogether can be a mistake. Sentiment can cause short-term price movements that may create opportunities for profit—or risk. Learn to balance both fundamentals and market psychology for a more holistic approach.

Markets are dynamic, and failing to adapt to new information can lead to losses. For example, if you’re holding onto a stock because the fundamentals were strong last quarter, but new data shows that the company is facing significant challenges, it may be time to reevaluate your position.

Mastering market fundamentals is the foundation of successful trading. By understanding supply and demand dynamics, keeping an eye on macroeconomic indicators, following corporate earnings, and staying informed about geopolitical events, you can build a strong, sustainable trading strategy. While the market may fluctuate in the short term, solid fundamentals will always give you a reliable guide to navigate through uncertainty.

Remember, success in trading isn’t about following the latest trend or using the flashiest indicators—it’s about understanding the forces that drive the market and using that knowledge to make informed decisions. As you continue to develop your skills as a trader, stay grounded in market fundamentals, and you’ll be well on your way to long-term success.

Copyright © 2025 WallSt 101 All Rights Reserved.

WhatsApp us